Slide 1

Optimizing Your Investment Landscape

Our Mission is to Increase Asset Owners’ Net Returns

and Enhance Investment Governance.

Slide 2

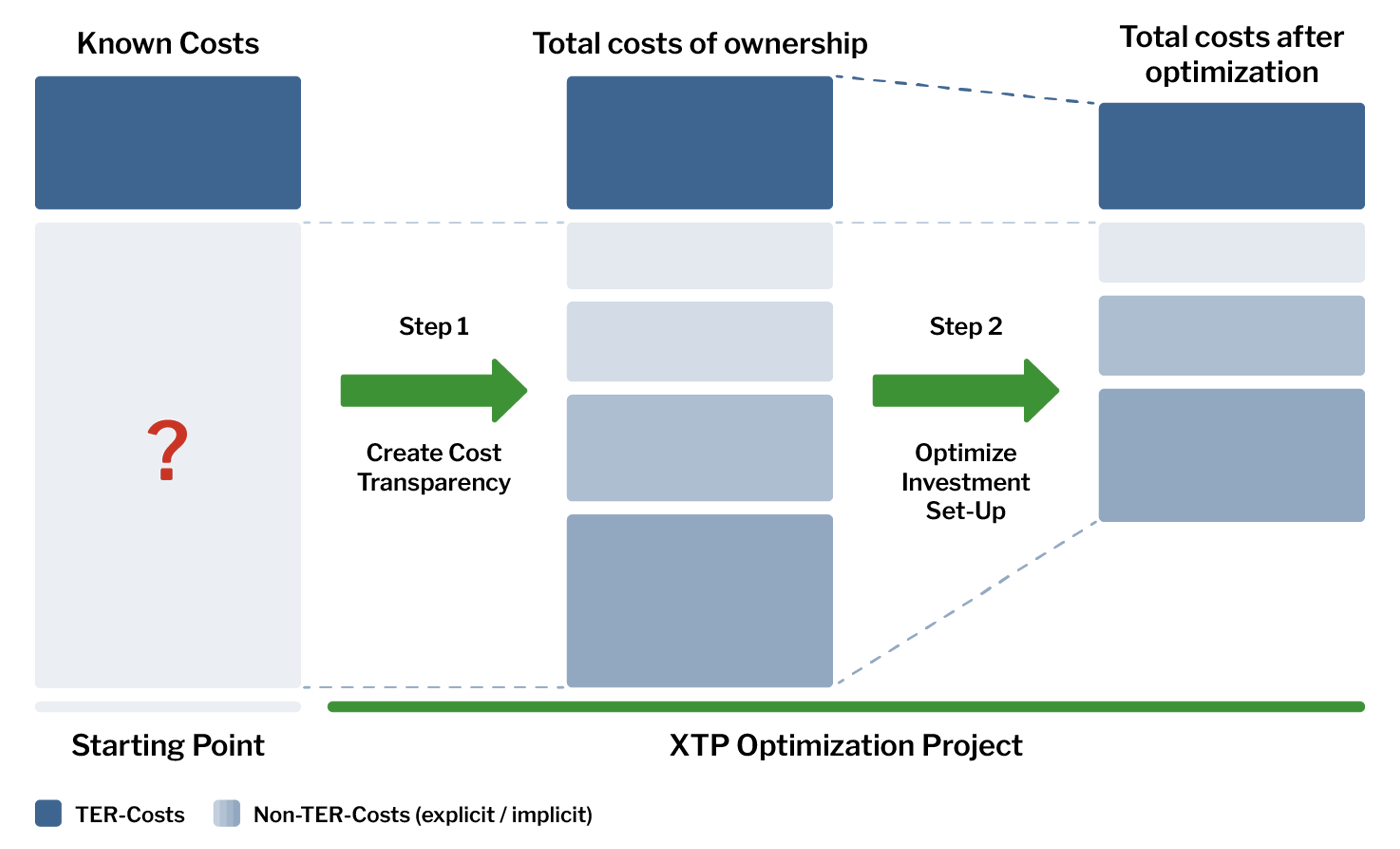

Turning Data Into Measurable Results

We Combine Deep Industry Experience with Proprietary Software, Data Bases, and Forensic Capabilities to Deliver Superior Results.

Slide 3

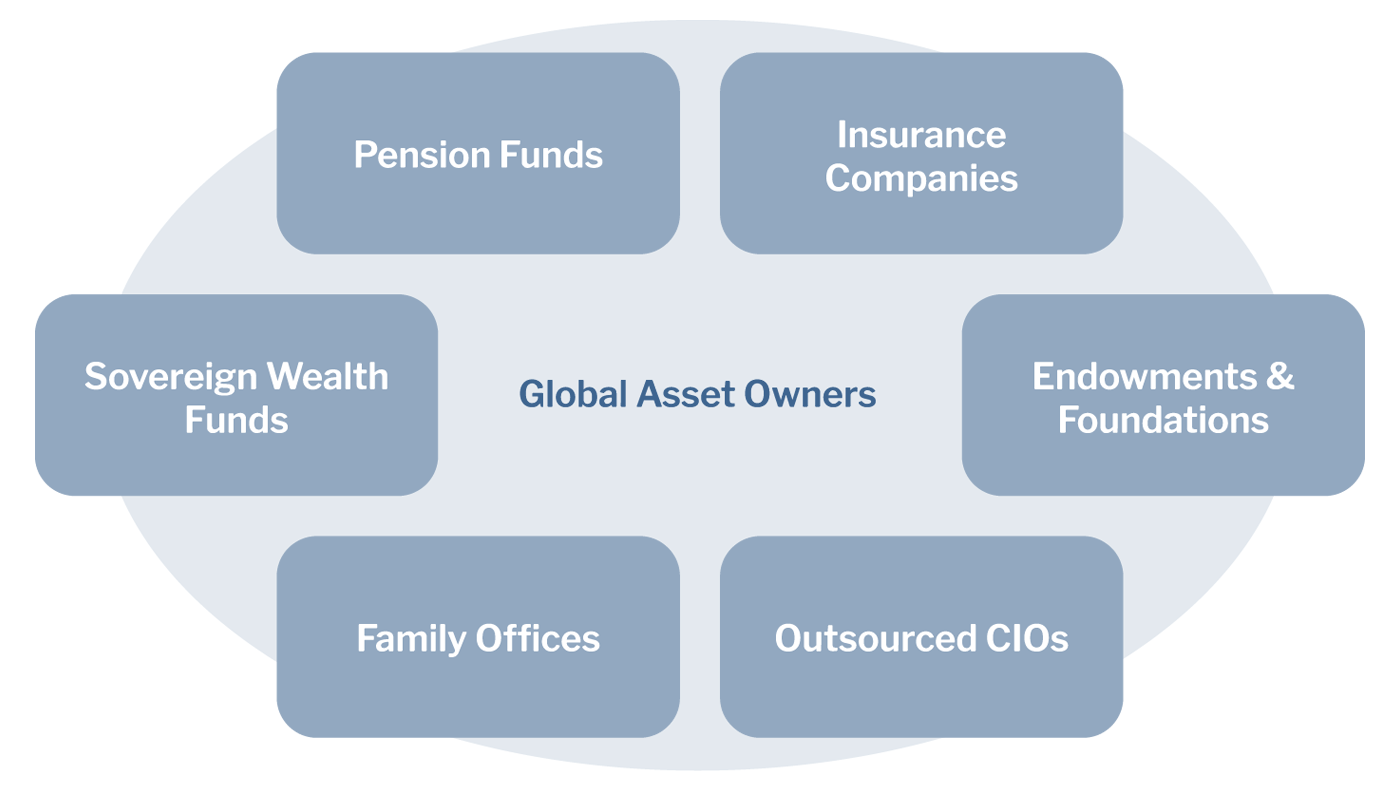

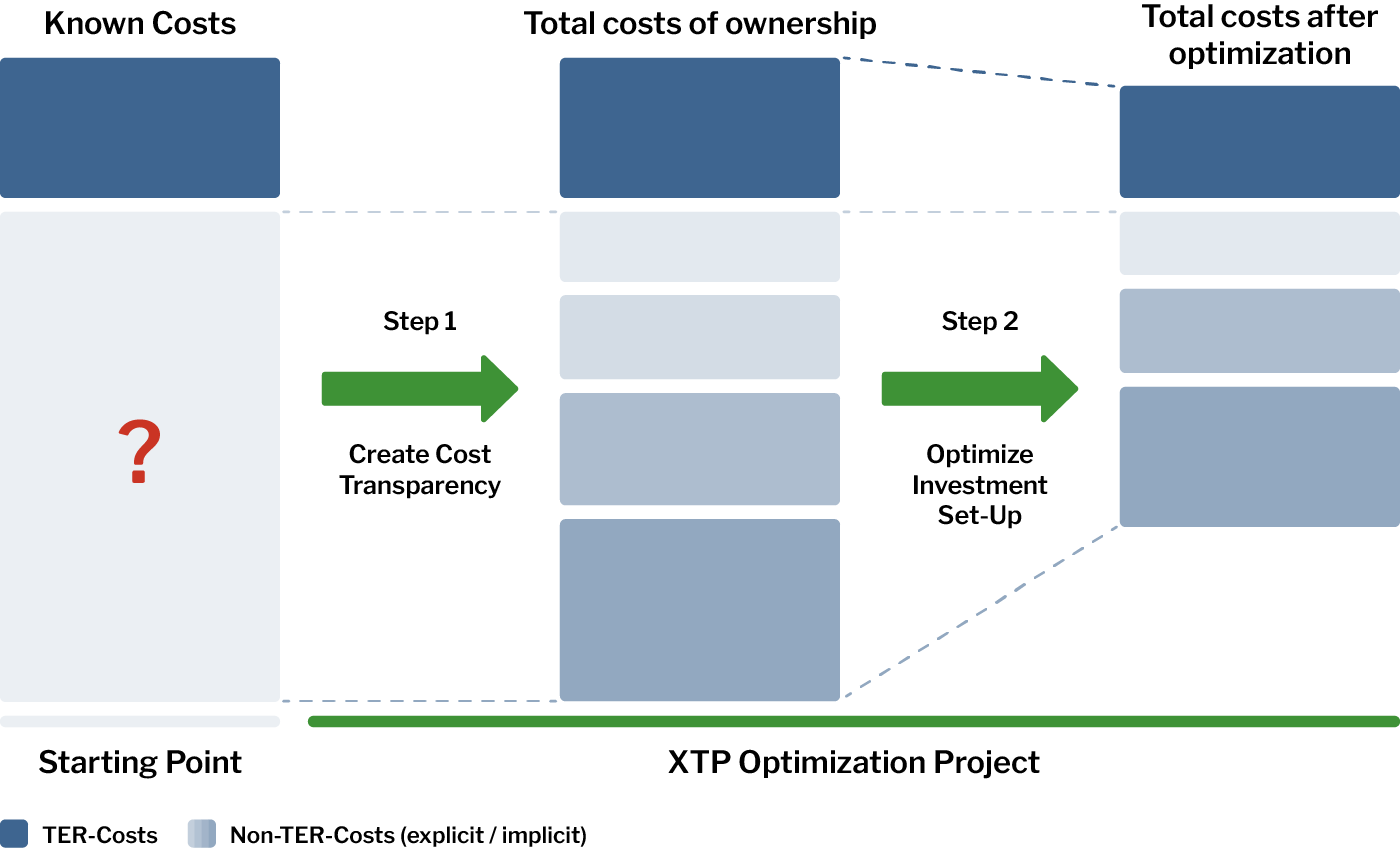

Taking a Holistic View on Your Investments

We Improve the Implementation Efficiency Across All Asset Classes Along the Entire Institutional Investment Value Chain.